PCAF-Aligned Emissions Calculation.

Version-Locked.

Governed. Deterministic.

The system emits an Audit Evidence Pack as a mandatory artifact of every run. All calculations are traceable to source data, methodology version, and emission factor set.

Alignment Definition: Formula-level adherence to published methodologies. No discretionary deviation.

Input Integrity

Enforced.

Most reporting failures occur silently before calculation even begins. The system creates a rigid perimeter around your data, rejecting ambiguous or incomplete inputs immediately.

Input Validation

Ingestion & Rejection Protocol

Uploads without required fields (vehicle type, fuel type, balance) are rejected pre-calculation. Record flagged and isolated.

Attribution Logic

Version-Locked Calculation

Records with attribution factors outside [0, 1] are rejected and isolated from aggregation. Changes to logic mid-period are forbidden. Workspace holds state.

Audit Trail

Centralized Execution

Workspace transitions that violate the state machine are rejected. All state transitions logged immutably. Audit logged.

Operational Constraints

The system does not rely on trust. It relies on four immutable invariants that govern every calculation cycle.

Methodology Lock

No calculation proceeds without a locked and strictly versioned methodology.

Source Lineage

No emission factor applies without a documented, traceable source and scope.

Explicit Quality

No data quality score is inferred. All quality scores derive from specific, explicit input fields.

Forward State

No workspace state regresses. Transitions are forward-only to prevent audit tampering.

Every step is enforced by

system constraints.

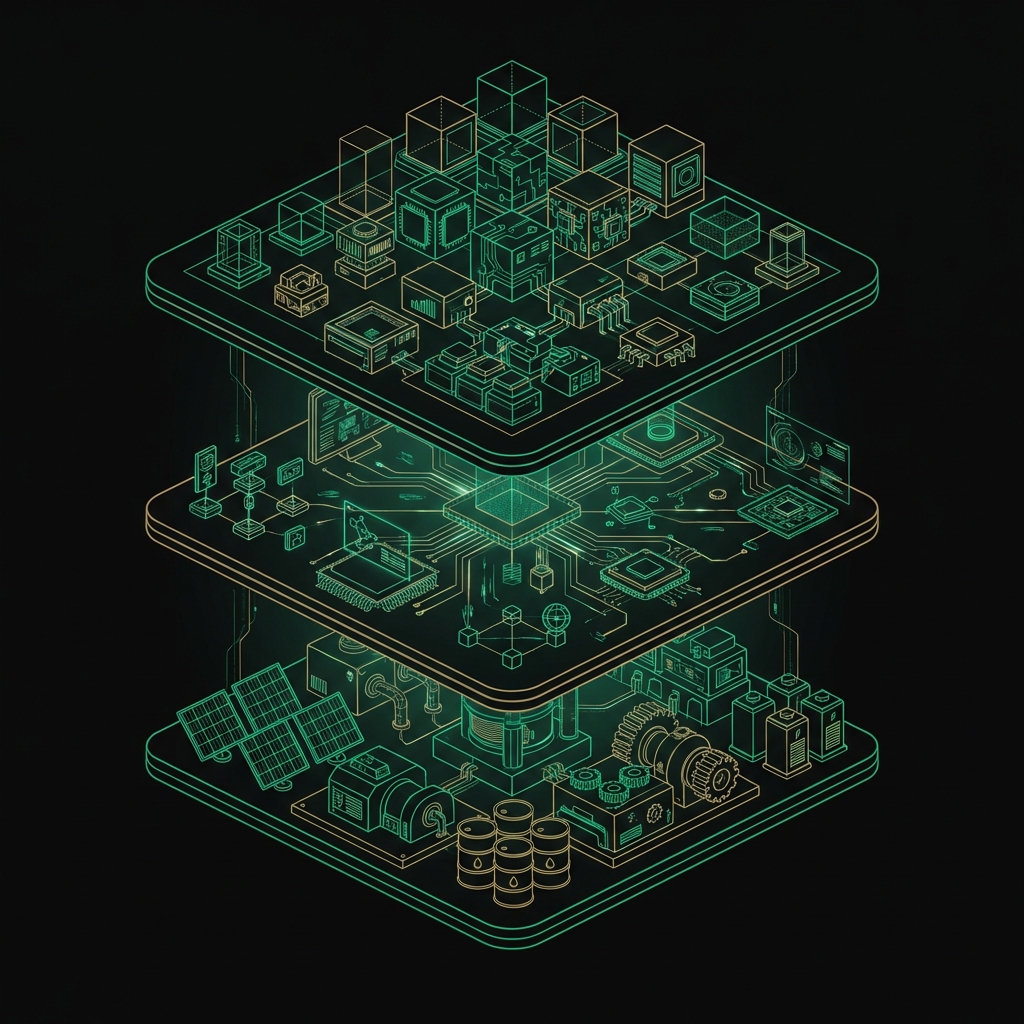

Bank Data Layer

Raw loan tapes and PII never leave your infrastructure. Local tokenization limits exposure.

Verification Core

Deterministic calculation engine. Produces an immutable, auditor-ready evidence pack.

PII never leaves

your perimeter.

The Bank Node runs on-premise within your infrastructure. It extracts loan data from your core banking system and tokenizes all personally identifiable information using HMAC-SHA256 with bank-held secrets.

-

What Leaves Your Network

Tokenized loan identifiers, vehicle specifications, outstanding balances. No names, no addresses, no customer PII.

-

What Peercarbon Receives

Data that cannot be reversed to identify individuals. Everything needed for PCAF calculation. Nothing that creates privacy liability.

-

Manifest Verification

Every data upload includes a cryptographic manifest with

pii_exported: falseassertion—verifiable by your compliance team.

The minimum infrastructure required for defensible financed emissions reporting.

System Capabilities (Enforced)Governance-ready data structures

Portfolio and operational data is standardized into finance-grade structures with preserved lineage, assumptions, and transformation history.

Deterministic financed emissions logic

PCAF-aligned emissions logic is applied consistently across portfolios and remains explainable under internal and external review.

Portfolio inspection and cross-asset comparability under disclosed assumptions

Climate exposure and comparability are surfaced across heterogeneous assets without forcing false precision or uniformity.

Governed climate finance logic

Where climate-linked financial products are deployed, validation and monitoring logic operates within predefined governance boundaries.

Audit Evidence Pack by Default.

The system is architected to produce an Audit Evidence Pack as a mandatory artifact of every run. No report is issued without its cryptographic lineage proof.

Governed State.

Every transformation is proven tracked back to its source policy.

The system enforces strict boundaries, ensuring that methodology configurations are locked against unauthorized change and traceable by third parties.

Assessing portfolio applicability?

Peercarbon is designed to operate across bank portfolios with materially different asset classes, data profiles, and reporting maturity.

Review how governed, PCAF-aligned logic is applied across common banking portfolios — without forcing uniformity or compromising auditability.

View asset class coverage